The converged communications industry is undergoing significant change. It has been well reported that fixed wireless access has captured most of the broadband industry’s growth, followed by fiber, with cable not adding customers, while DSL gets rapidly replaced. Recon Analytics’ research also shows that a substantial number of fixed wireless access subscribers did not have dedicated home internet access before; hence, it is not a zero-sum game.

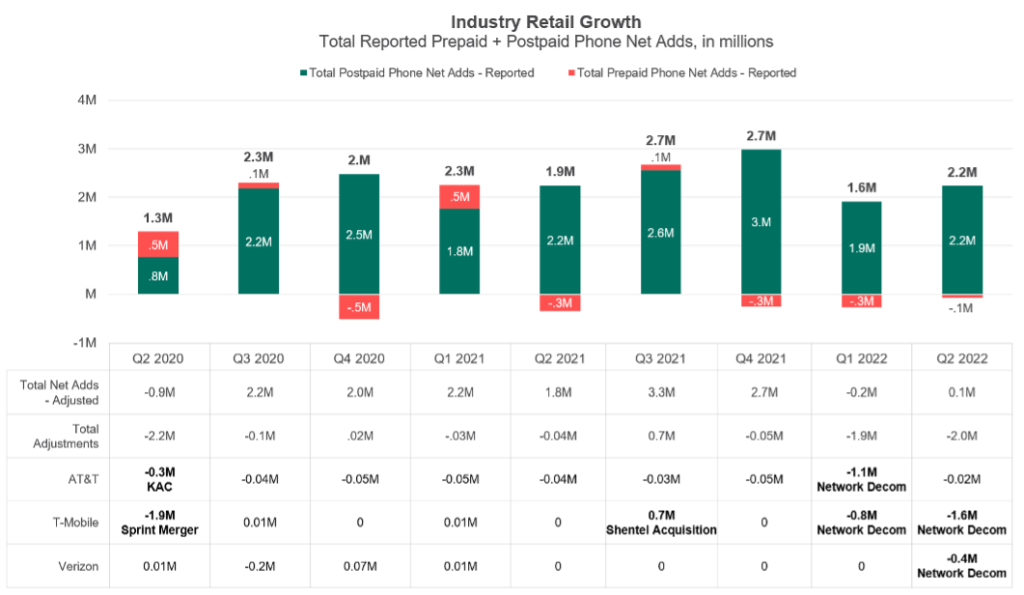

Adjustments are common in the wireless industry. An operator buys another operator, customers switch from prepaid to postpaid or vice-versa, new rules on what it takes to continue to be a customer get implemented – essentially, a cleanup of the subscriber base. These changes are typically in the low hundreds of thousands, important but not earthshattering. With the shutdown of 3G networks, we are entering another period where these changes are significant. No matter what we call these disconnections and whether they are included in the churn statistics or not, they still represent a reduction of subscribers in the industry. These adjustments to what is and is not a subscriber and where that gets counted provide valuable insights into the health of the wireless industry.

In the chart below, we are looking at the overall phone universe and see that the two segments have more overlap than what many people want to acknowledge. The orthodox, adjustment-free view shows us solid growth over the last two years and creates the perception that industry growth exceeds population growth followed by exasperated questions of “Where are they all coming from?”

When we look at the impact of the adjustments, a different view emerges. For example, in Q2 2020 there were two significant adjustments: a clean-up of the Keep America Connected disconnects by AT&T and, more importantly, a large adjustment by T-Mobile as part of the Sprint merger. Sprint had created a bit of a mess ahead of the merger and counted people as customers who might really live up to that moniker. It counted some connected devices as phones, didn’t disconnect people even though they were significantly in arrears, and counted prepaid Boost customers who financed a device as postpaid. As a result, 1.9 million subscribers disappeared from the books. The total subscriber numbers actually show a reduction of 900k subscribers despite an “official” 1.3 million subscriber gain. We saw a similar trend due to the 3G network shutdown at AT&T and T-Mobile. What looked like strong subscriber gain quarters were actually flat quarters due to the disconnects of 1.9 million and 2 million 3G subscribers. We will see further adjustments when Verizon shuts down its 3G later in the year.

The interesting implication of the adjustments and their use to net out the official numbers is that the three mobile network operators did not add subscribers in the first half of 2022. The entire growth of the wireless sector comes from the cable industry in the form of Charter and Comcast.

In 2011, Verizon was in a pickle as it could project when it would run out of spectrum and needed to maintain its strategy of being the network leader in the United States. The deal was straightforward: get spectrum from the cable companies in exchange for an MVNO agreement and hope that the cable companies will be as successful as they were in their previous attempts with Sprint, which is not at all. This premise held up until 2017, when Comcast started offering service, followed shortly thereafter by Charter. The two cable operators went to market by positing that they could offer the best network experience for combined mobile and home internet for roughly the price of a premium wireless subscription. Customers liked the premise, and cable providers have consistently been between a quarter and a third of industry postpaid net adds, taking a healthy bite of the wireless industry growth. Examining Comcast’s and Charter’s total market flow share performance, which includes prepaid and postpaid, it becomes clear that Verizon is coming out ahead. For example, during July 2022, based on our Recon Analytics Data services, only 27% Comcast’s and Charter’s customers have come from Verizon. Tracking Verizon’s revenue components for many years, we estimate that Verizon gets an average of $13.13 from its MVNOs per customer, which include providers like US Mobile, Red Pocket Mobile, Lively, Affinity Cellular to mention only a few. A comparison between Verizon’s $18.35 EBITDA contribution and its $13.13 MVNO revenue per customer, which is almost pure profit, shows that Verizon is coming out significantly ahead. For every Verizon customer that moves to Comcast and Charter, three join the Verizon network from other providers, both postpaid and prepaid. The 661,000 Comcast and Charter net adds in Q2 2022 contributed an incremental $41.4 million in overall annualized revenue. If Verizon would disclose more numbers and be more transparent, it could easily dispel the erroneous notion that its wholesale business is a negative for the overall business when it is clearly not. While Verizon’s branded subscriber base which it reports quarterly is under pressure, its unreported network share is performing substantially better. More people are using the Verizon network today than ever before, and its wholesale partners are an underappreciated part of the story.

The headwinds that Verizon is facing are coming from its two main rivals T-Mobile and AT&T. T-Mobile continues to perform well with a “have your cake and eat it too” positioning by marketing a superior network at a lower price value proposition. Considering that it trails AT&T in postpaid phone net adds, we can only conclude that the message could be resonating better. AT&T is leading the industry with a straight-forward consistent promotion strategy for new and existing customers. The lack of fading-in and fading-out promotions that the two other operators are offering is paying off for AT&T. The new AT&T leadership has transformed the company from being the source of everyone else’s growth to being the fastest growing postpaid phone provider in the United States.

To take the fight back to the cable providers and utilize fallow spectrum, T-Mobile and Verizon have launched fixed wireless internet access to compete against traditional home internet providers. With 2.1 million fixed wireless customers between them, they have captured the buzz of the telecom market. With easy to set up wireless routers, straight forward pricing, and speeds around 100 to 300 Mbps, FWA providers are on top of Recon Analytics’ net promoter score list in every one of the 14 metrics we are tracking. What we see in our FWA flow share analysis is that FWA is currently a threat to every other technology, as it captures many disgruntled home internet subscribers who are looking for a different, attractively priced option. The questions are: How long can this last? and From where geographically do these customers come?

The main constraining factor is the availability of fallow spectrum and the usage profile of home internet users. It is not uncommon that home internet users use 500 to 800 GB per month compared to approximately 15 GB for a mobile user, while paying around less than $50 per month for their subscription. In urban and suburban areas, due to the much higher population density and approximately the same amount of spectrum, the maximum amount of fixed wireless customers before they impact wireless user experience is much more limited than in rural areas. In rural markets, fixed wireless access performance is much more driven by cell site density rather than the availability of spectrum. At the same time, rural America has the problem of being by definition rural, which means not a lot of people live there.

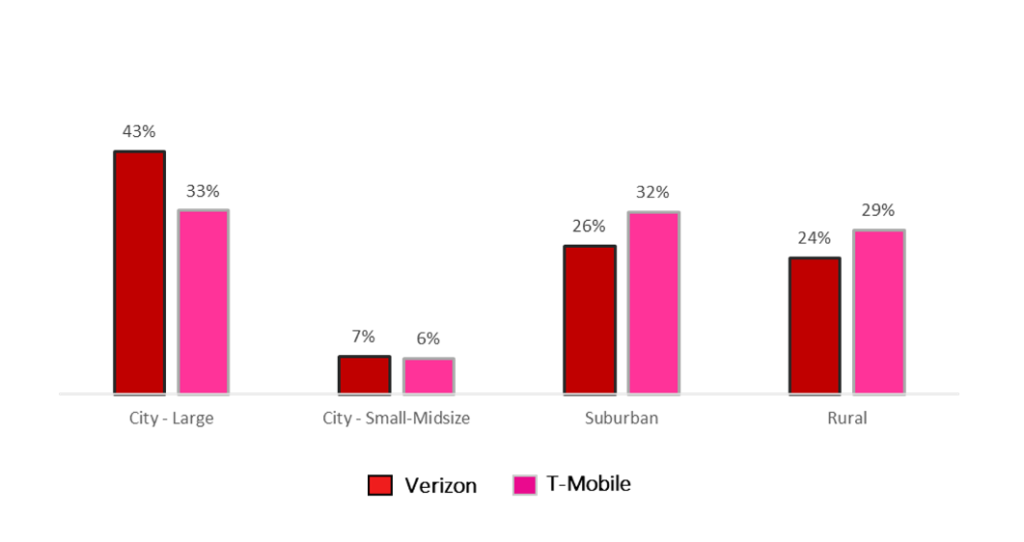

Fixed Wireless Subscriber by Urbanicity

Source: Recon Analytics Data, April to August 2022

Both Verizon and T-Mobile have been a lot more successful in urban and suburban markets than in rural markets, which is both an opportunity and limiting factor at the same time. The much-touted transformation of rural connectivity is still a lot more talk than reality. T-Mobile’s new Home Internet Lite plan demonstrates the strain on the network from unlimited plans. It introduces usage-capped price plans in the name of being customer friendly and allowing to be available everywhere. The positioning will be that not everyone needs unlimited data and with a fixed amount of data rather than unlimited data these customers and it allows T-Mobile to charge a higher price per GB in constraint areas. At the same time, it makes T-Mobile closer to the cable companies it derided in the past that have usage caps. It also proves AT&T’s argument that fixed wireless is not a fiber replacement in many places.

The competitive intensity is greater than ever before and the battle ground is larger than before. The battle for market share in this new converged communications provider world has just begun, with the tides of the battle swinging back and forth.