A week into the C-Band auction, all signs point to an intense struggle for spectrum among the auction participants. With 5G deployments in full-swing, the 280Mhz of mid-band licenses being offered sit directly in the ‘goldilocks zone’ that straddles attractive propagation characteristics -good in-building penetration and range- and 20Mhz blocks large enough to deploy significant capacity and speed for 5G.

For bidders looking to use spectrum quickly, the 100MHz that makes up A block for the auction is scheduled to be cleared as early as 2021 while B and C block licenses may not be available until 2023. As such, A block licenses for 46 of the top 50 markets can be bid on separately and will likely come at a premium compared to B and C block licenses in the same market.

While we won’t know who bid on which markets until the auction is over, for each round the FCC reports the demand for licenses versus those available via the public reporting system. For each round, in every market where demand exceeds supply, the price increases by 10% for the next round. Ten percent may not sound like much initially, but exponential growth soon catches up and markets with intense bidding quickly get expensive. For example, after ten rounds where demand exceeds supply the price more than doubles, after twenty rounds it increases by six-fold and after fifty rounds the price has increased to 100x the original cost.

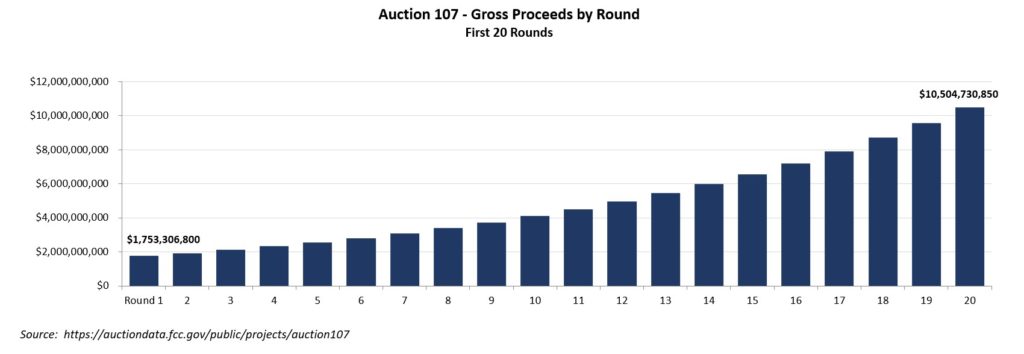

Price escalation invariably forces decisions on even the most well-heeled bidders, but we have not yet reached that point with the C-Band auction. So far the volume of markets with bids over supply has INCREASED, not decreased, resulting in over $10.5B gross proceeds across the 411 markets offered through round 20.

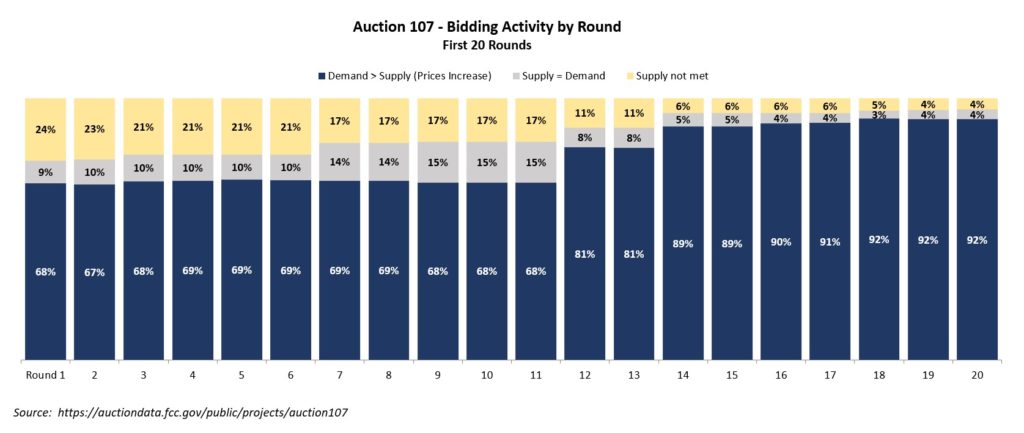

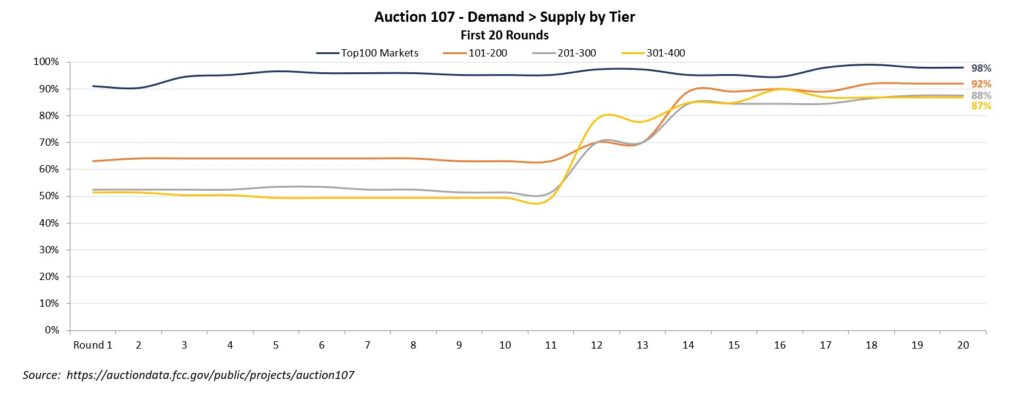

What is interesting about the C-Band auction so far is that the bidding volume for smaller markets that typically happens later in the auction has heated up early. During the first ten rounds demand for roughly 2/3rds of markets exceeded supply and therefore increased in price by 10% every round. Starting in round 12 bidding volume increased. This increased volume catapulted markets with price increases from 68% of all markets to 81% of all markets and continued to build to over 90% of all markets by round 17.

Digging a bit deeper, the jump in markets with more demand than supply that began in round 11 was driven by an increase in interest in smaller population markets while prices for larger markets were still not settled. Through round 10 only about half of markets lower population tier markets ranked 100-400 had more bids than supply, but by round 15 over 86% of markets ranked 100-400 by population had more bids than supply.

But what about those A sub block licenses that could help the winner race to deploying mid-band 5G? There are only 5 sub blocks available per market, but bidding for many of the top markets through 20 rounds still shows bids in the double digits in excess of supply. In fact, demand for A block markets is still so strong that in the first 20 rounds every A sub block in the 46 markets increased in price every round. That adds up to a 612% increase over 20 rounds and over $3.5B of the total gross proceeds of $10.5B across the entire auction.

Bidders seem to be slowly adjusting to the expectation that they may not win the entire A block. In round 18 demand for the top 39 markets dropped by 2 to 3 units across all markets, likely indicating a coordinated pull-back by one bidder. While demand has fallen across the top markets, none of the A block markets have reached bidding equilibrium where supply equals demand and price increases cease. At current pace the licenses in A sub block markets would be collectively worth over $5B in just 5 more rounds and over $10B by round 32.

Within A sub block, which markets are most popular among bidders? As always, the top 10 markets have among the highest demand, but the market with the most demand in excess of supply so far is Salt Lake City, the 27th largest market in the auction, with 4 bidders for every available block (5 blocks available, 15 in excess of supply). A cluster of markets follow Salt Lake City for second most activity: Chicago, Dallas, Miami, Houston, Orlando, Las Vegas, Kansas City, Austin and Milwaukee all have 12 bids over supply (total bids of 17 each).

So what can we learn from the first week of the C-Band auction? At $10.5B through round 20, the levels of interest in mid-band 5G spectrum are sky high. Verizon and AT&T’s well understood need for mid-band 5G spectrum is surely playing a role in the bidding intensity, but bidding volumes suggest there are also other players willing to throw their hat in the ring, particularly for the A block which will be available soon. Regardless of who wins, it’s likely we’ll see consumers enjoying the benefits of C-Band 5G sooner rather than later.