Innovation and a desire to compete is the basis of success. After years of languishing, T-Mobile has regained its competitive vigor with the reverse acquisition of Metro PCS. The secret of T-Mobile’s success is three pronged:

- First, the company went ahead and put the $3 billion and spectrum they got from AT&T when that merger went awry and combined it with the Metro PCS spectrum to rapidly build an LTE network in their existing footprint on their existing towers, covering 180 million POPs by September 2013.

- Simultaneously, T-Mobile announced the Un-Carrier strategy, which was a refresh of the Value Price Plan initiative, to great fanfare. The first phase of Un-Carrier does away with handset subsidies and replaces them with a device installment plan. In essence, for the first 24 months of the plan, a consumer won’t see a change in what they pay. After 24 months, however, the payment goes down to a device-free price, which is about $20 lower—assuming the consumer does not chose to purchase a new device. Considering that Americans purchase on average a new device every 21.7 months, only a few consumers will likely see the lower payment.

- Third, on July 14, 2013, T-Mobile launched the JUMP program, which allows the consumer to upgrade their device every six months by resetting their device purchase program when they trade-in their device with at no charge. The program, which costs $10 per month, also includes a device insurance program, which previously cost $12 per month. This makes the JUMP program a no-brainer for T-Mobile customers who would have taken the device insurance program anyway. Within days, AT&T and Verizon announced similar programs. Sprint announced its rapid handset program more than two months later, on September 20th.

To gauge the success of T-Mobile’s JUMP program, Recon Analytics conducted a detailed survey using Google Custom Surveys between August 26 and August 30, 2013. Results were immediately accessible to our advisory members.

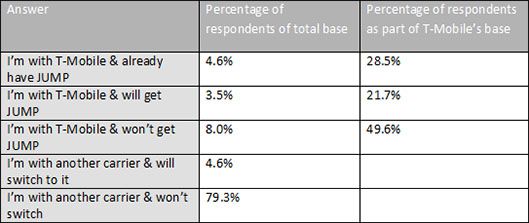

We found that six weeks after the launch of the program on July 14, 2013, 28.4% of 4,183 respondents were aware of the JUMP program. This is a substantial level of awareness considering the short time the JUMP program was being promoted and the relatively low share of voice that T-Mobile advertising represents in the advertising world. We followed up this question with second multiple-choice question to the 1,002 respondents who were aware of the JUMP program asking them how interested they are in the JUMP program.

Top Line JUMP Survey Results

A couple of things are interesting here. Among the respondents, 28.5% claim they already have JUMP. This percentage is a rough match for the percentage of wireless subscribers who have a device insurance plan. If, indeed, everyone who said they would sign up for JUMP will take up the JUMP plan, then more than half of T-Mobile’s subscribers (50.4%) will be on the JUMP plan. Considering that the JUMP plan is 16% cheaper than the traditional handset insurance plan with is part of JUMP, one has to be concerned about potential impact of the JUMP plan on T-Mobile’s profitability.

Because the device can be traded-in for a device of the same price after six months without additional payments, one can only wonder who is paying for the value decline of the traded-in device. Similar to a new car, which loses most of its value the moment it drives off the lot, mobile phone see their value decline even faster because the replacement cycle is much more rapid. Someone has to pay for the decline in the device’s value and it’s not the consumer. It is almost inevitable that the JUMP program will need to get adjusted.

The other interesting result is that 4.6% of the respondents want to switch from their current carrier to T-Mobile for the JUMP service. Part of the 4.6% were Sprint customers who had no comparable choice until a few days ago. Sprint probably saw early indications of switchers to T-Mobile and scrambled to get their own program out the door.

AT&T’s and Verizon’s programs are different than T-Mobile’s. Most notably, neither AT&T’s and Verizon’s plan charge a program fee and neither include an insurance program for the fee or a discount to monthly charge. Regardless of which carrier they choose, consumers that frequently upgrade their devices will pay less in the long-term.

While the Un-Carrier campaign, JUMP, and LTE are driving growth in the customer acquisition, T-Mobile has also been able to reduce churn significantly. A little known fact is that roughly half of total gross adds in markets where T-Mobile and Metro PCS were competing against each went between those two carriers. The companies were competing against each other to a greater degree than any other carrier pair. When the two carriers merged, suddenly the external churn that was counted in both carrier’s metric was internalized. Logically, the churn dropped. As a result, net additions for T-Mobile increased substantially without increasing churn among the surviving carriers in the market place.

T-Mobile’s turnaround has been impressive, built by focusing on innovation, “investment” and a fortuitous choice in merger partners. The fundamentals of T-Mobile’s growth should stay intact for at least another two quarters if no competitor makes a significant change, but we are all waiting for Sprint to unveil their new plans under new ownership. One can only hope for Sprint that they will be unveiled this year because it now faces three formidable competitors.