Inflation has become a top-of-mind concern for everyone, leaving consumers, businesses, and the investment community on the edge of their seats. How are consumers reacting to the largest increase in prices of the last four decades? Which businesses get impacted and does Wall Street come to the correct conclusions?

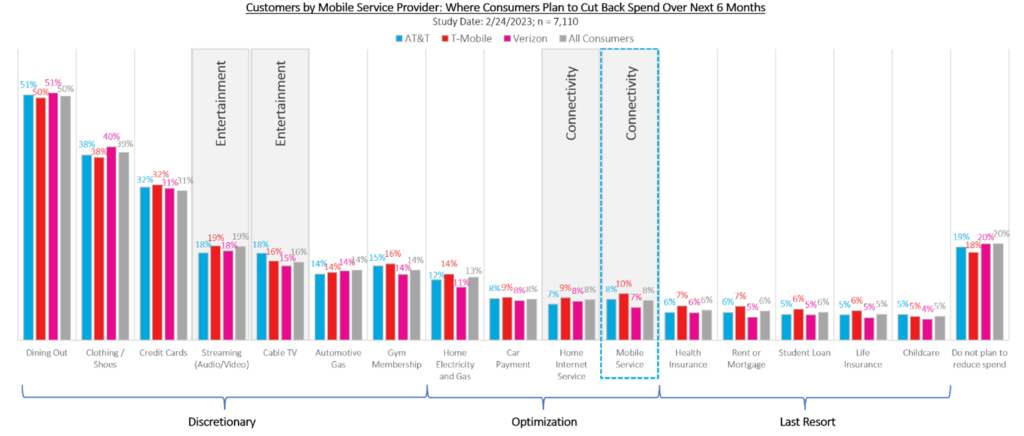

At the end of February 2023, we ran a module as part of our weekly Mobile Consumer and Home Internet Pulse surveys with 7,110 respondents telling us in which spending areas they would cut back. In a nutshell, people would rather cut back on electricity, heating or car payments than home internet or mobile service.

By far the number one category where consumers are cutting back is dining out. A whopping 50% of consumers are expected to increase their at-home dining and reduce their spending at restaurants. It’s the easiest way to cut back as consumers, now trained in the art of cooking due to the Pandemic, can easily replace an expensive meal with home cooking. At the same time McDonalds is at an all-time high stock price based on cutting their regional sales structure. You can’t cut yourself to growth. Verizon is a cautionary tale of what happens when you cut your regional sales structure and take away the ability to build a deep and wide management bench by having a large number of P&Ls where people can learn the business. Dining out is followed by clothes shopping where 39% of respondents are curbing their spending. It’s not that people will walk around in rags, but the pace of clothing purchases is going down, especially hurting the fast fashion segment. General consumer spending through credit cards was mentioned by almost one-third of consumers as a means to address increasing prices.

Scaling back on streaming services is the fourth most popular expenditure reduction segment among consumers, with 19% planning to reduce their spending on streaming video and audio services. We run a monthly Streaming Content Module that receives over 90,000 respondents annually, in which we explore the streaming habits of Americans. According to our April 2023 Streaming Content Module based on 7,642 respondents, on average, consumers have access to 3.6 subscriptions – 2.5 subscriptions for which they pay out of pocket, 0.6 subscriptions received through a mobile service or home internet bundle and 0.5 subscriptions they get access to through password sharing. In addition, 16% of consumers are planning to cut their cable TV bundle ensuring that cord cutting continues and making the looming death of linear television ever more likely. We are not sure if the TV writer’s guild calling for a strike realizes that fewer and fewer people will realize that no new content is being produced. Some people might even use the lack of new content as a sign that it is time to cancel it all together.

Fourteen percent of respondents were planning to cut back on gas for their cars and on gym membership. Although many people rely on their cars to drive to work, there is a car-use component that is optional and can be reduced as a cost-saving measure.

Only eight percent of respondents are planning to cut back on their home internet and mobile service expenditures due to inflationary pressure, barely more than the number of people who will cut back on health insurance and housing. The difference between subscribers at MNOs is nominal with only 7% of AT&T customers at the low end and 9% of Verizon customers at the high end looking to reduce their spending on home internet services. The numbers on average are even lower for mobile service, with only 7% of T-Mobile customers and 8% of AT&T customers looking to reduce their mobile costs.

For the eight percent looking to reduce their mobile service expenses, their preferred route is to switch to a new provider that offers a similar plan to what they’re currently receiving but at a lower price point. Their secondary choice is to downgrade to a more affordable plan with their current provider. Savings via device discounts also play a significant role among this subset, with more than half willing to switch to a new provider to obtain the best deal on a new device to find further cost savings.

As a last cost-cutting resort, 6% of consumers would scale down their health insurance, rent or mortgage or student loan payments in response to inflationary pressure. Life insurance and childcare costs have the greatest inflationary-resistance, with only 5% of people looking to cut back costs within each category.

Lastly, despite inflation concerns throughout the economy, roughly 20% of respondents have indicated they do not plan to decrease their financial spending. With percentages this low, telecom has essentially become recession proof.