Over the last two years, in addition to attracting new customers, most of the wireless industry has focused on better serving its existing consumers with products and services those consumers want. We all watch more mobile video and play mobile games. As a result, an unsung hero—in form of the tablet—has emerged. Launched only 4 years ago by Apple, the iPad was quickly imitated by others. Initially, the main focus was on Wi-Fi-only tablets, which are only connected close to a hotspot. But now, as Wi-Fi-only tablet sales slow, LTE-connected tablets have gained in popularity and have become a significant growth source for carriers as the traditional mobile phone business weakened and shifted considerably.

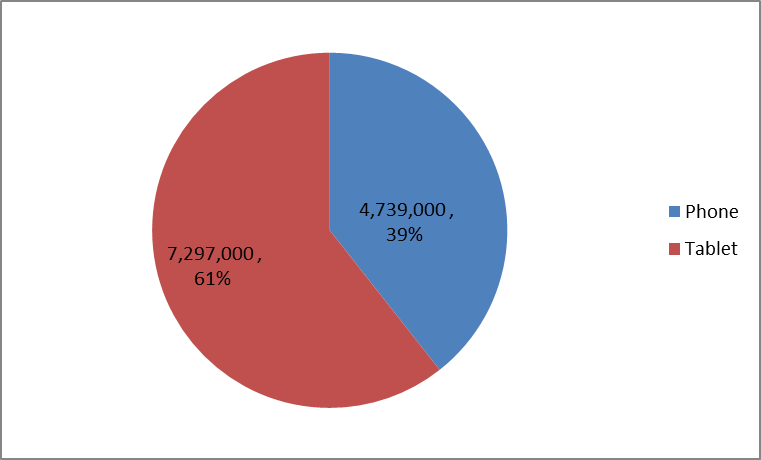

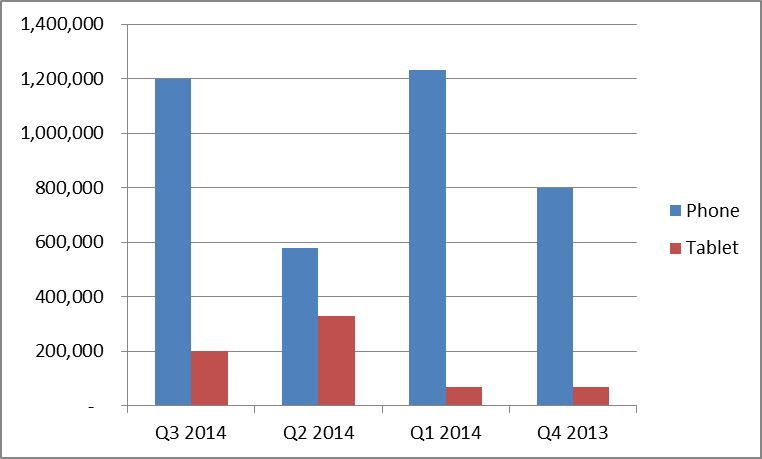

Exhibit 1: Postpaid branded net additions by device category, Q4 2013 to Q3 2014

This trend culminated over the last four quarters, with 61% of the branded postpaid growth of the four nationwide operators coming from tablets. This development shows the tremendous change that the mobile industry is continuing to undergo and identifies a significant driver of the growth in data consumption by the most suitable device—tablets—for media consumption and gaming.

Why have consumers, who in years past mostly ignored tablets with wide-area connectivity, suddenly shifted their purchasing behavior? Three factors led to this significant change:

1) The cost of service has declined: The introduction of mobile share plans has made tablets economically possible for consumers. Before mobile share plans, adding a tablet meant a separate data plan with a separate data allotment for $40 or more—in addition to paying $100 or more for the tablet with wide-area connectivity compared to a Wi-Fi only device. With mobile share plans, adding a tablet is typically only $10 per month, still within the realm of impulse buying or cheap enough justify it as a way to pacify a child in the back seat of the car or a husband needing to watch NFL Sunday games just about anywhere.

2) The cost of tablets has declined: A substantial decrease in the cost of wide-area connected tablets from various manufacturers has made them more affordable. While wide-area Android tablets were as much as $500 when they were first introduced as a lower-cost alternative to Apple iPads, the unsubsidized retail cost has come down to roughly $250 without a contract or commitment. If a consumer enters a 2-year contract the cost of the device is $100, but even that is frequently discounted down to zero.

3) Equipment installment plans have made devices even more affordable: A $250 tablet is generally about $12.50 per month on an installment plan offered by the nationwide operators. As many Americans generally prefer to pay over time instead of upfront, the addressable market for tablets increased substantially.

Not every operator is, or has been, equally dependent on tablets for their growth. Tablet promotions have become the operator’s weapon of choice to make their quarterly postpaid branded subscriber growth number. When we look at how dependent operators are on tablets for growth, quite an interesting picture emerges.

For Sprint, a Beacon of Hope

Even as Sprint went through a sea of troubles attracting new subscribers to their network, its success in tablets served as a beacon of hope for the company. The company jumped aggressively on the tablet trend and succeeded in satisfying customer demand.

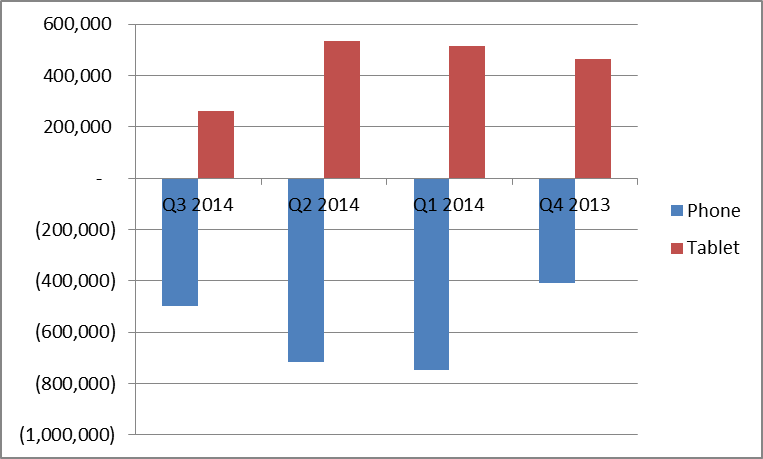

Exhibit 2: Sprint postpaid branded net additions by device category, Q4 2013 to Q3 2014

While Sprint lost almost 2.4 million branded phone connections in the last four quarters, it gained almost 1.8 million new tablet connections. Losing 600,000 postpaid branded connections is nothing to write home about, but without its tablet sales, results would have been even more devastating.

AT&T, the Balancing Pioneer

AT&T was at the forefront of meeting customer demand for tablets. Because it was ahead of the market and other carriers in satisfying consumer craving for entertainment on the go, it initially struggled with the profitability of selling subsidized tablets. After developing the market and volumes, the overall market moved in AT&T’s direction. As a result, other operators shared the efficiency gains that come from higher sales volumes.

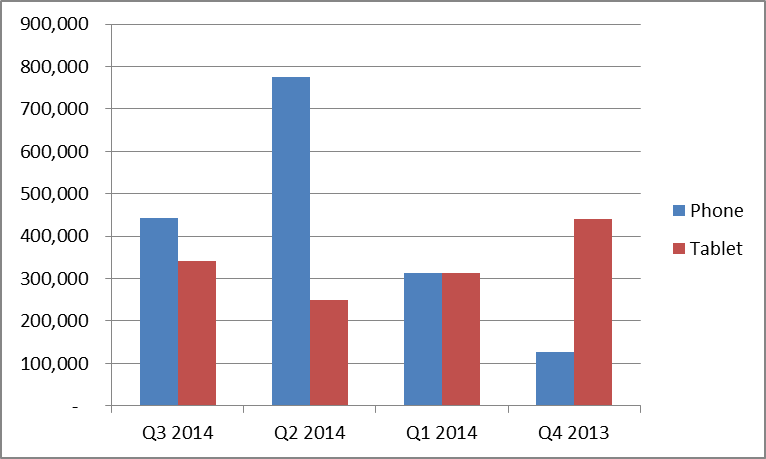

Exhibit 3: AT&T postpaid branded net additions by device category, Q4 2013 to Q3 2014

AT&T achieved the second most branded postpaid phone additions in the industry by capturing 1.65 million new phone customers, slightly ahead of Verizon Wireless but less than half of T-Mobile. It also added 1.45 million tablets, which represent 45% of its net additions for the last four quarters, giving AT&T the most balanced growth of the nationwide carriers. Slightly behind AT&T in recognizing the trend towards tablets, Verizon Wireless’ results show that more focus often leads to better results.

Verizon Adds Almost as Many Tablets as the Other Carriers Combined

With a slightly larger customer base and slightly less new phone customers (1.64 million), Verizon Wireless added twice as many new tablet connections as AT&T with 3.5 million, compared to AT&T’s 1.3 million.

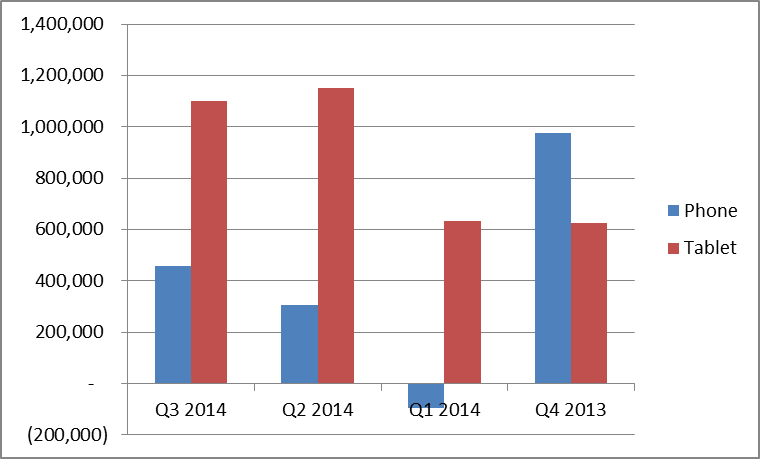

Exhibit 4: Verizon postpaid branded net additions by device category, Q4 2013 to Q3 2014

With more than two thirds of its postpaid branded net additions coming from tablets, Verizon Wireless had the highest net postpaid branded subscriber net additions. Since the majority of the growth was meeting the needs of current customers rather than new customers, it significantly overestimates the strength of the customer acquisition engine of Verizon Wireless. While Verizon Wireless can be satisfied that it added more connections than anyone else, being number three in branded postpaid additions in its core segment must be a wakeup call in Basking Ridge.

T-Mobile’s Lack of Tablet Focus Hides Future Growth Potential

T-Mobile’s relentless drive to innovate—sometimes more substantive than at other times, combined with a CEO that has almost become a Jesus-like figure to some—has yielded spectacular new branded postpaid customer growth. T-Mobile added more than 3.8 million new phone customers, growing faster than the rest of the industry in new phone customers combined. The operator was near death before John Legere arrived. He changed the rules of the game in wireless, revitalized the organization and took it to previously unknown heights.

Exhibit 5: T-Mobile postpaid branded net additions by device category, Q4 2013 to Q3 2014

The only weakness in T-Mobile’s performance was its lackluster additions of tablets. Despite being the only operator that offers free data for life for tablets, T-Mobile added only a small fraction of tablets compared to its competitors. The company, which focused on new customer phone growth, largely ignored tablets as it added only 665,000 new postpaid branded tablets, a third of what Sprint achieved with roughly the same subscriber figures. But this apparent weakness in tablet sales now also gives T-Mobile the opportunity to go back to its current customers like its competitors and, with sufficient focus, add one to three million more tablets in future quarters.