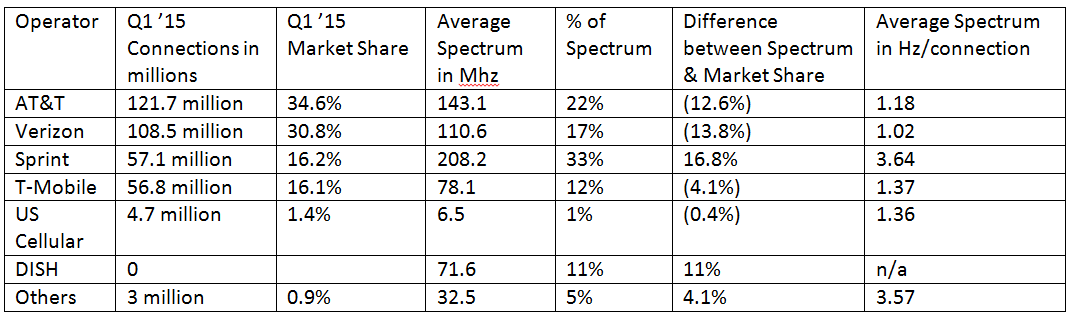

Another hot topic is the upcoming incentive auction. The amount of available spectrum per subscriber tells us how much capacity the carrier has to serve its customers and therefore what the theoretical upper limits of data speeds are. It also shows us how urgently the respective carrier needs more spectrum to serve its customers at par compared to their competitors.

The most spectrum constrained operators are Verizon Wireless with 1.02 Hertz per connection (Hz/c) and AT&T with 1.18 Hz/c. Verizon Wireless is definitely more constrained than 1.02 Hz/c as it only reports retail connections. Their per-connection stats do not reflect M2M or IoT connections that also use spectrum. T-Mobile, as it correctly boasts in its advertising, has more capacity per subscriber than Verizon and AT&T, with capacity per subscriber serving as a proxy for amount of spectrum the company has per subscriber. Specifically, T-Mobile has 34% more spectrum per subscriber than Verizon, and 16% more than AT&T. By comparison, Sprint has 2.6x to 3.6x times more than Verizon, AT&T or T-Mobile. Regional carrier US Cellular has 16% to 33% more spectrum per subscriber than AT&T and Verizon.

Exhibit 1: Q1 2015

Source: The Companies and Recon Analytics analysis

Exhibit 1 helps us understand why Sprint and T-Mobile have decided not to participate in various auctions. Quite simply, neither company faced an immediate need for more capacity and could not make a business case for spending money to buy spectrum at the time various auctions were being held. Both companies’ share of spectrum ownership and market share are more closely aligned than that of their larger competitors. T-Mobile and Sprint famously sat out the 700 MHz auction for that reason and it was an eminently reasonable business decision; however, now comes both Sprint and T-Mobile asking the FCC to give them a guaranteed reduction in price for the spectrum the companies may be interested in buying in the upcoming incentive auctions. Despite Sprint’s comments on its fiscal first quarter 2015 investor call where it said it is still contemplating participating in the Incentive Auction, Sprint has little actual need for significantly more spectrum compared to its peers.Source: The Companies and Recon Analytics Analysis

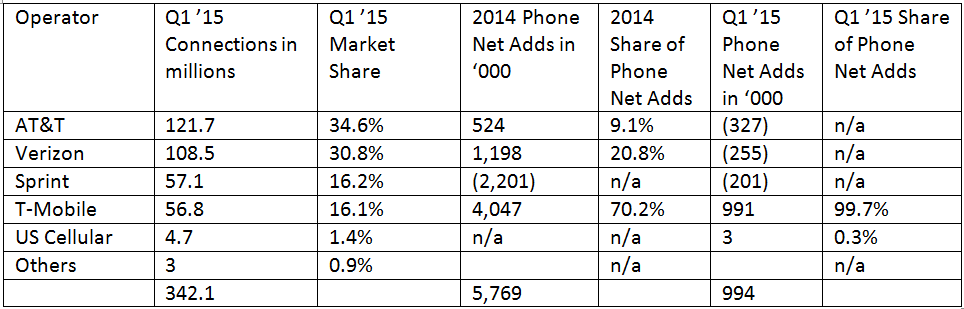

Analyzing the competitive forces in a market often looks at market share as an important metric. By its nature, market share is a description of the competitive results of the past. In the past, AT&T and Verizon Wireless executed their business plans substantially better than Sprint and T-Mobile, resulting in more customers choosing them over the competition. Now, T-Mobile and Sprint want to use the results of the past to restrict their larger competitors today. As we see in Exhibit 2, AT&T and Verizon could not stop T-Mobile from growing faster than the entire market combined for 2014 and Q1 2015. Hardly the result of a duopoly having a strangle-hold on the market. When just looking at the carriers that grew customers, T-Mobile captured 70.2% of the growth in 2014, twice as much as AT&T and Verizon Wireless combined, and 99.7% of the growth in Q1 2015. For a duopoly that is a remarkably poor showing exhibiting none of the supposed power that would need to be restricted.

Exhibit 2: Q1 2015

Source: The Companies and Recon Analytics analysis

T-Mobile and Sprint are trying to convince the FCC that it’s just not fair that other companies spent more money to buy and deploy spectrum and now have a more diverse spectrum portfolio. The two companies are also claiming that a guaranteed price reduction for them in the upcoming auction will somehow resolve the reality of AT&T and Verizon being larger providers with more customers. If one takes the advocacy at face value, one could believe both companies are struggling to stay alive and American consumers are suffering from soaring prices and deteriorating service absent FCC action.Source: The Companies and Recon Analytics Analysis

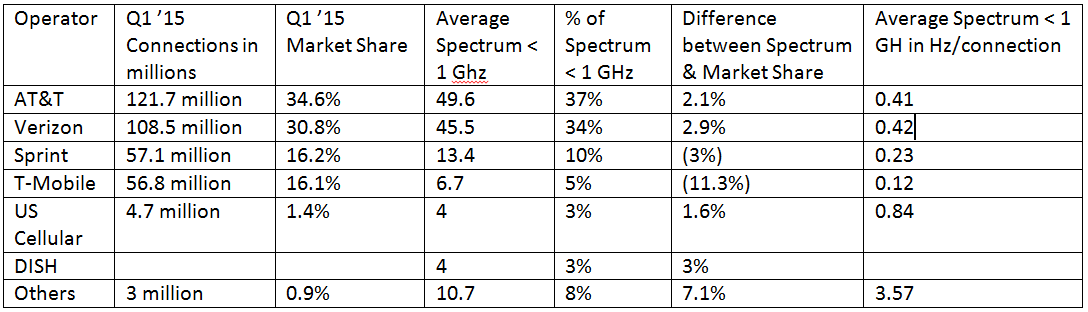

A key datapoint often used to convince regulators that the FCC should set aside spectrum for T-Mobile and Sprint in the upcoming incentive auctions is the amount of spectrum each major provider holds below 1 GHz. AT&T and Verizon, who bought most of their 1 GHz spectrum from other providers such as the successor of McCaw Wireless, US West and Alltel respectively, own roughly the same amount of spectrum as what one would expect considering their subscriber numbers. Sprint, largely through its acquisition of Nextel and the subsequent re-banding of the Nextel spectrum, owns slightly less than would be expected. T-Mobile, which chose not to participate in any low band spectrum auctions, now holds about 5% of the available low band spectrum through its acquisition of 700 Mhz A-band spectrum from Verizon. T-Mobile indicated that it would like to extend its 700 MHz spectrum holdings further. Interestingly, small rural telcos, which make up the Others category in Exhibit 3 below, control more low band spectrum than T-Mobile despite T-Mobile being 18-times larger.

Exhibit 3: Spectrum below 1 GHz

Source: The Companies and Recon Analytics analysis

If the FCC is interested in having set-asides, perhaps a better idea than giving more spectrum to T-Mobile and Sprint at a discount, would be to make 20 MHz available for small rural operators. This would essentially triple the spectrum available to them and will allow them to be part of the same 600 MHz ecosphere as their larger brethren, while giving them approximately three to ten times more spectrum per subscriber than anyone else. When it comes to download speeds, US rural operators will be in a better position than anyone else to deliver the fastest possible speeds if the FCC were to set aside 20 MHz of spectrum.Source: The Companies and Recon Analytics Analysis

Whether the FCC should or should not grant T-Mobile’s and Sprint’s requests to be treated as special, protected entities just like small, rural operators is a matter of policy and politics but one should not be fooled into thinking that T-Mobile and Sprint are weak sisters who would not otherwise be able to compete. While Verizon, Sprint and AT&T are growing by selling more products and services to fewer customers, T-Mobile is growing by consistently adding new customers. T-Mobile has captured 99.7% of unique subscriber growth in the industry. Since it went public in May 2013, the stock price of T-Mobile USA has almost doubled, while its competitor’s share price has fallen. Sprint is not as successful as T-Mobile, but it is slowly working itself out of a disastrous network upgrade program that saw dead spots appear where there were none before. In a large number of markets, Sprint is now winning network accolades from third party measurement companies. Net Promoter Scores, a leading indicator, are improving, overall subscriber numbers and tablet sales to existing customers are increasing and phone customer losses are decreasing. Everything is pointing up as long as Sprint executes well.

There are various, competing priorities at play regarding the upcoming incentive auction. The stakes are particularly high because the auction was authorized by an Act of Congress without the option of a re-auction if it fails. Broadcasters want to be compensated, spectrum needs to be reallocated to use for wireless broadband, existing TV broadcaster operations need to be consolidated, and last but not least government revenues need to be maximized. The fewer the restrictions, the smaller the set-asides, the more revenue will be generated during the auction. This is a particularly important consideration for the incentive auction where the demands of the broadcasters will have to be met before the US Treasury will get its cut. The most recent government estimate of its revenue cut of the incentive auction is $10 billion to $40 billion. How the expected $80 billion auction total will be achievable from an industry that had 2014 operating income of just over $40 billion is difficult contemplate. The problems get compounded when roughly a third of the spectrum will be set aside for bidders claiming poverty and looking for a substantial discount but which already have vast amounts of spectrum in their portfolios. If the FCC decides to retain set-asides for the upcoming auction, it would be better served by making them available to small rural providers, not the large nationwide providers.