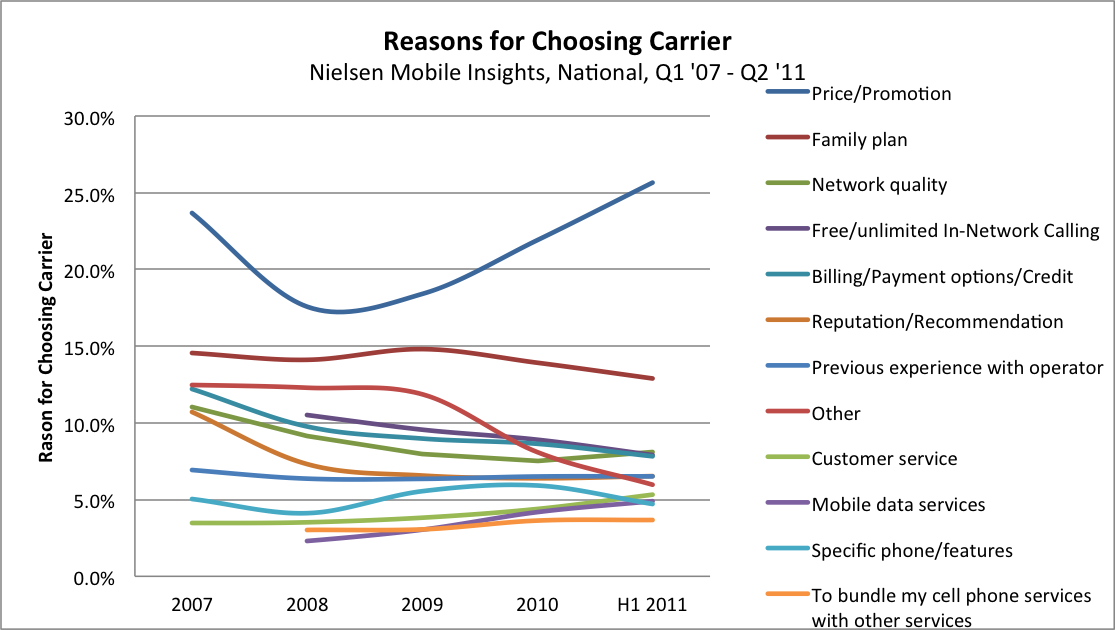

The reasons for choosing a wireless carrier changes over time but then do they really change that much? New data from Nielsen shows the trends.

With the current merger between AT&T and T-Mobile underway, the reasons why and how people pick their carrier are quite significant, and the data is certainly illuminating. The most important purchase decision factor is price, and it has become more important since the beginning of the recession. Mobile data services is the purchase decision factor that, other than price, has more than doubled in importance over the last three years.

Not surprisingly, price and promotion are the most important purchase decision factors and they have resurged since a low in 2008. Three years ago, in 2008, 17.6% of people said they picked their carrier based on price. In mid-2011, this skyrocketed to 25.7%, due to the continued difficult financial times many Americans are experiencing. With price being the most important purchase factor, one would think that T-Mobile, which is described by many merger critics as the low cost provider in the industry, would flourish and consistently gain customers. However, T-Mobile is losing customers. How can that be? The reason is that T-Mobile is actually the most expensive low-cost carrier in the country. Providers that offer prices lower than T-Mobile – Metro PCS, Leap Wireless, and Tracfone – are growing by leaps and bounds, capitalizing on this shift back to price consciousness.

The importance of Family Plans and Free in-Network Calling has lessened over the last several years. In 2008 and 2009, the combined metric was actually more important than price to consumers with a 2009 high of 24.4% for the combined metric versus 18.4% for price. Sprint adeptly recognized both the threat and the opportunity that lay hidden in that data point. Their inability to match Verizon’s or AT&T’s free calling circles was strangling the carrier’s gross additions and they had to break free from it without destroying value by going unlimited. The Any Mobile, Any Time plans, which offer free calling to any mobile device did exactly that. It provided a better value by offering more free mobile calling at a lower price. The plan was launched in September 2009. The impact was immediately measurable with a significant uptick in gross additions. The massive impact of this plan, supported by a focused marketing message, turned around the fortunes for the Sprint-brand of the company. The relative decline of this metric may indicate the need for Sprint to adjust their go-to-market strategy.

Network quality as the most important purchase decision factor has also declined since 2007 from 11% to 8.1%. This represents a maturing of the networks in major urban areas, where the difference between the best and the worst networks – contrary to the vitriol on blogs – has actually declined. It is now a matter of “good enough” not of being perfect. This is a dangerous trend for Verizon, where network superiority has been a cornerstone of the company’s success . It’s massive 4G LTE build-out is a testament that the company still believes it can revive the network theme when making the generational shift to LTE. The industry-leading net subscriber add numbers are supporting that the investment was well spent, especially as it shifts its network superiority investment and message to wireless data.

Billing, payment choices and credit declined in importance as each carrier basically offers the same options.. The only carrier that offers something unique is AT&T with Rollover Minutes, where unused minutes can be carried over for up to one year.

Contrary to the hype we hear on the internet, that people will leave the combined AT&T and T-Mobile if the merger goes through, only 6.5% consider the reputation of the carrier as their main reason for choosing their operator, down from 6.9% in 2007. The facts just don’t support the rhetoric. This is similar to the impending doom that would befall AT&T if Verizon acquired the iPhone. In Q2 2011, AT&T sold more iPhones than Verizon, even though Verizon grew faster than AT&T in the first full three month period when the devices were available at both carriers.

The reputation of the carrier and the recommendations of others are becoming less important to Americans as they have more and more first-hand experience with the majority of operators. The 6.5% of respondents that consider carrier reputation their most important decision criterion represents about a quarter of the people who consider price the most important reason for choosing a carrier. In 2007, 10.7% considered this the most important factor in choosing a wireless carrier. In mid-2011 it was down to 6.5%. Bundling continues to be a minor issue, with only 3.7% making it their top priority, albeit up from 3.1% in 2008.

With so many Americans having first-hand experience with various carriers, and mobile devices becoming more complex, it is no surprise that customer service is an increasingly important factor. In the first half of 2011, 5.3% of people responded that customer service was their main reason for choosing their carrier, compared to 3.5% in 2007.

About 4.7% of Americans consider a specific phone (everybody can guess that this is code for the iPhone, since it gets the juices going like nothing else) to be the main reason for choosing a wireless carrier. A sobering fact – being, in fact, the second to last important factor in choosing a provider – considering how high handset exclusivity is on the mind of many policy makers. Just as the discussion is heating up in Washington, the importance is declining compared to previous years. In the first half 2011, it has declined below the 2007 percentage.. The drop is particularly large when we compare 2010 with first half of 2011 with 5.9% compared to 4.7%. About 25% fewer people consider a given device their number one decision factor after the iPhone was available from both AT&T and Verizon. With the rumored launch of the iPhone on T-Mobile and Sprint in the fall, the number will probably decline even further.

Last, but not least, mobile data services have significantly gained in importance over the last several years. Considering that more than two-thirds of the devices sold in this country are smartphones, it is hardly surprising. In 2008, only 2.3% considered data their most important decision criterion for selecting a carrier. By the first half of 2011, this has increased to 4.9%. With America’s love affair with accessing their data and being entertained by their mobile devices, continuing to grow, this number will only go up. Considering that this fall, everyone will largely have the same device line up, the network that powers mobile data services will become ever more important. The days are over when some operators were able to skimp on their 3G data networks or could even skip it completely due to the dominance of voice. A carrier will have an extremely hard time competing if it doesn’t have a 4G network in 2012 and beyond.